Most Economists Believe That the Best Monetary Policy Target Is

Monetary policy into a new policy instrument in its own right. Friedman and Schwartz as well as some other monetarists believe that the Fed conducted a tight money policy during the early 1930s despite the fact that the monetary base rose sharply.

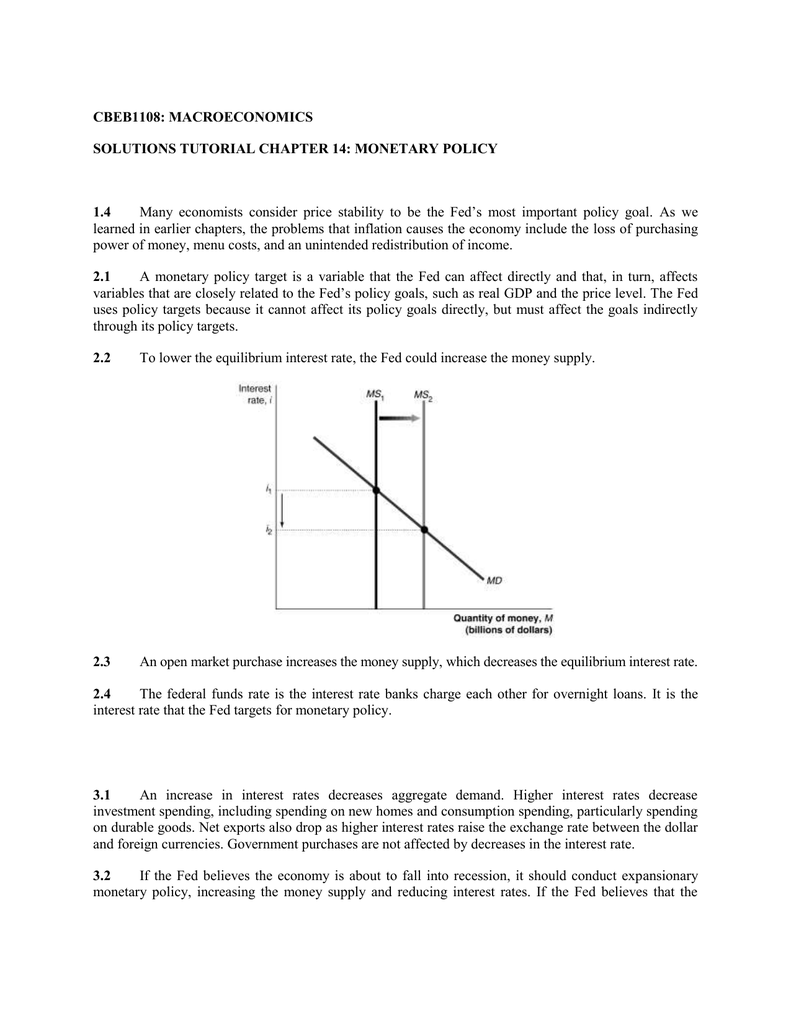

Monetary Policy And The Debate About Macro Policy Ppt Download

Specifically the Congress has assigned the Fed to conduct the nations monetary policy to support the goals of maximum employment stable prices and moderate long-term interest rates.

. Monetary policy refers to the actions the the money supply and interest rates. One is that a higher inflation target should mean fewer cases where monetary policy is trapped against the zero bound. Monetary Policy in the Wake of the Crisis Olivier Blanchard Let me start with my bottom line.

Kitco News - With market expectations so high for action the European Central Bank has no choice but to loosen its monetary policy on Thursday economists said. Central banks decision to stimulate the economy during the global recession of 200709. Monetary policy set by an independent central bank would target inflation and stabilise the economy.

Intermediate targets can be any economic variable that is not directly controlled by the central bank. Before the crisis mainstream economists and policymakers had converged on a beautiful construction for monetary policy. Policy direction would be clear and based on the level of headline CPI which the Monetary Policy Committee is mandated to target.

Economists simply cannot and will not imagine a monetary system that provides no jobs money status or power for economists. To caricature just a bit. The problem with a short-run focus of multiple goals and objectives most economists believe is that monetary policy has its greatest impact principally in the long runand primarily on the price level only.

Monetary policy refers to the actions the. There was one instrument the policy rate. Federal Reserve takes to manage the money supply and interest rates to pursue its macroeconomic policy objectives.

But the debate has come right back in a direction that most didnt anticipate. In the current cycle that target is set at 4 - 2 percent. Targets set by the Federal Reserve as part of its monetary policy goals.

When prices are stable long-term interest rates remain at moderate levels so the goals of price stability and moderate long-term interest rates go together. Nathan Lewis quite simply has a masterpiece on his hands. We had convinced ourselves that there was one target inflation.

He suggests that a 2 inflation target works because firms and households set their prices wages in expectation that prices nationally will rise 2 thereby generating the Feds desired 2 price. I believe central bank talk will continue as a policy instrument in the future despite what I like to call The Great. As Ben Bernanke 2015 col-orfully put it monetary policy is 98 percent talk and only two percent action Paul Volcker would never have said that.

Price stability high employment economic growth and stability of financial markets and institutions. 5 To explain how such changes affect the economy it is first necessary to describe the federal funds rate and explain how it helps determine the cost of short-term credit. In those cases maintaining the target would mean higher inflation to go with lower real growth.

Monetarism gained prominence in the 1970sbringing down inflation in the United States and United Kingdomand greatly influenced the US. The Federal Reserve Systems four monetary goals are. It will not be.

Debt management would be handled by the DMO. By the late 1990s a new framework was in place. The federal funds rate The FOMCs primary means of adjusting the stance of monetary policy is by changing its target for the federal funds rate.

This is easily the most important book of 2013 arguably the most important economics book in a long time and the best book on money that. A future-focused review must question Reserve Banks inflation target Rather than criticise past central bank decisions the focus should be on whether targeting nominal income might be the best. British households can look forward to another year of ultra-low interest rates with most economists expecting a maximum 1 per cent by the end of 2016.

The Taylor Rule suggests that the Federal Reserve should raise rates when inflation is above target or when gross domestic product GDP growth is too high and above potential. So if the American economy is hit by a real shock an NGDP target might mean inflation at 5 and. The Federal Reserves two main monetary policy targets are the money supply.

Economists expect the central. And like every regime a nominal-GDP target has its drawbacks not least that few non-economists have ever heard of the concept. Most economists believe that the best monetary policy target is Federal Reserve takes to manage the money supply and interest rates to pursue its macroeconomic policy objectives.

On average each day US. With a target of 1 the funds rate will be at zero around 9 of the time. Monetarists believe that the objectives of monetary policy are best met by targeting the growth rate of the money supply.

Just five out of. Many economists think changes in the base are the most straightforward way of defining the stance of monetary policy.

Solved Table 29 4 Bank Of Cheerton Assets Liabilities Chegg Com

Monetary Policy And The Debate About Monetary Policy Ppt Download

Comments

Post a Comment